IT & ERP Advisory Services in UAE

- Home

- IT & ERP Advisory Services in UAE

Empowering Businesses Through Smart Technology & Digital Strategy

ERP Advisory Services, In today’s fast-moving digital landscape, businesses in the UAE must adopt the right technology to remain competitive, compliant, and scalable. At The First Check, we offer tailored IT advisory services and tech product solutions that align your technology investments with business goals—from startup stage to enterprise growth.

Whether you’re looking for ERP implementation, cybersecurity solutions, or digital transformation support, we deliver secure, scalable, and ROI-driven IT strategies.

Our IT Advisory & Product Solutions Include:

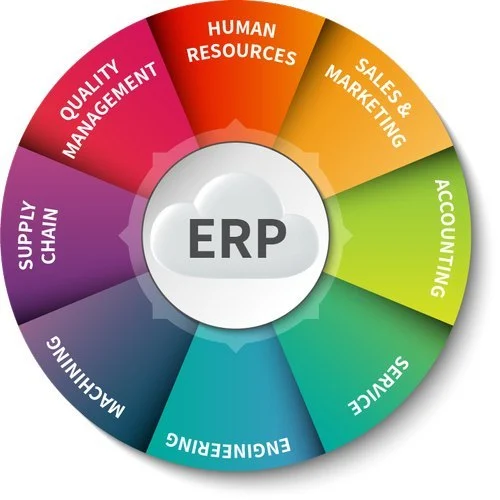

ERP Advisory & Implementation (UAE-Focused)

- ERP vendor selection & comparison (Zoho, SAP, Oracle, Odoo, etc.)

- Business process mapping & automation

- Full-cycle ERP implementation & support

- Inventory, HR, finance, CRM & procurement modules

- ERP training, change management, and integration with VAT/Tax systems

Custom Software Solutions

- Bespoke software and mobile app development

- CRM and HRM tools tailored for UAE business needs

- Accounting & payroll tools (WPS-ready)

- Secure document management and digital filing

- System integration with FTA & regulatory portals

IT Infrastructure & Cloud Services

- Cloud migration (AWS, Azure, Zoho, Google Cloud)

- IT network setup & management for SMEs

- Backup, disaster recovery & uptime monitoring

- Hardware procurement & licensing (MS Office, QuickBooks, etc.)

Cybersecurity & Compliance

- Risk assessment & security audit

- Firewall, antivirus & endpoint protection

- Regulatory compliance (GDPR, DIFC, DFSA, AML tech requirements)

- IT policy development & user access control

- Data encryption & breach prevention

ERP Advisory Services in UAE

The First Check has been actively involved in the fields of ERP implementation and consulting services. Over the past 15+ years, we have been capable of providing optimized management solutions and ERP services covering business processes such as implementation, consulting, operation & maintenance to domestic as well as overseas enterprise users. The First Check is one among the best erp consulting companies in Dubai, UAE. We value your time and money and our major focus is on the return on your valuable investment of both.

Frequently Asked Questions

- 1. Why do you need an ERP consultant in UAE?

You know your business inside out, and it’s you who also knows your employees inside out, but still to manage all under one roof is a tedious task. ERP consultants understand business management systems inside and more importantly, they can help you in identifying the gaps in your system.

2. What does an ERP consultant do?

ERP consultants are responsible for the initial study, designing, implementation and maintenance of Enterprise Resource Planning systems for businesses. Basically, they would support you to establish a centralized system to manage the entire process flow.

3. What should be our criteria of selecting an ERP Partner in UAE?

- They should be certified consultants with at least 15+ years technical experience

- Should have knowledge in your domain and previous implementation history in your industry

4. What are the biggest benefits of implementing an ERP solution in UAE?

- Reduced operational costs and increased revenue

- Centralized dashboard for managing processes efficiently

- Gain visibility into your end-to-end processes

- Analytical reporting structure for better decision making

- Automation of manual processes